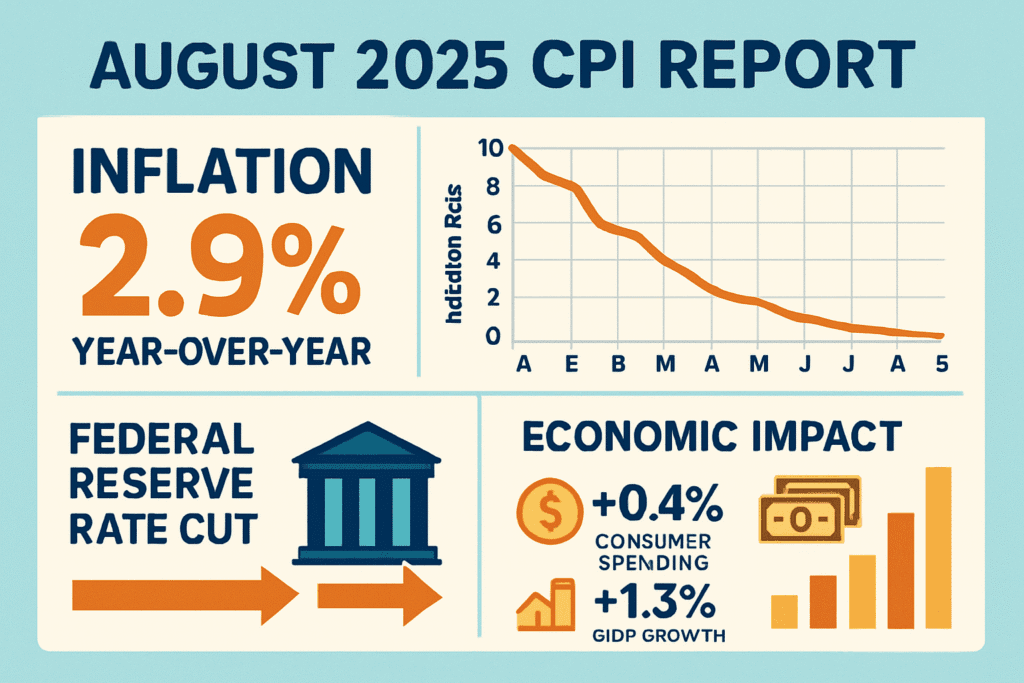

The latest CPI report for August 2025 has sent shockwaves through financial markets as inflation accelerated to 2.9%. This comprehensive analysis examines the Federal Reserve implications and economic impact.

🔥 Breaking: August 2025 CPI Report Key Highlights

The CPI report August 2025 revealed concerning inflation trends that exceeded economist expectations. Consumer prices rose 0.4% monthly, doubling July’s 0.2% increase. This marks the highest annual inflation rate since January 2025.

Critical CPI Data Points:

- Annual inflation rate: 2.9% (vs 2.7% in July)

- Monthly increase: 0.4% (expected 0.3%)

- Core CPI: 3.1% annually (unchanged)

- Energy prices: +0.7% monthly

- Food prices: +0.5% monthly

- Shelter costs: +0.4% monthly

💰 Federal Reserve Rate Cut Implications

The Federal Reserve rate cuts strategy faces new complications following this CPI report. Market analysts now predict a more cautious approach to monetary policy adjustments.

Fed Policy Outlook:

Quarter-Point Reduction Likely: CME FedWatch tool shows 88% probability of 0.25% rate cut at next week’s meeting. The sticky inflation data reduces chances of aggressive 0.50% cuts.

Powell’s Dilemma: Fed Chair Jerome Powell must balance inflation concerns against labor market weakness. Recent jobless claims jumped to 263,000 – highest in four years.

Market Reactions: Stock futures showed mixed responses, with technology sectors outperforming defensive plays.

📊 Detailed CPI Breakdown Analysis

Food & Energy Sector Performance

Food Inflation Acceleration:

- Home food prices: +0.6% monthly

- Restaurant prices: +0.3% monthly

- 12-month food inflation: 3.2%

Energy Price Volatility:

- Gasoline prices: +1.9% monthly surge

- Electricity: +0.2% increase

- Natural gas: -1.6% decline

- Annual energy inflation: just 0.2%

Core Services & Shelter Costs

Shelter remains the largest inflation contributor, with rent increases accelerating across major metropolitan areas. This persistent pressure suggests inflation expectations may remain elevated longer than anticipated.

Notable Price Changes:

- Airline fares: +5.9% (vacation season impact)

- Used vehicles: +1.0% (supply chain recovery)

- Apparel: +0.5% (back-to-school demand)

- Medical care: -0.2% (prescription drug policies)

📈 Economic Impact & Market Analysis

Stock Market Response

The CPI inflation data triggered varied market reactions across sectors:

Winners:

- Technology stocks gained on rate cut certainty

- Financial sector benefited from higher rate expectations

- Energy companies surged with commodity prices

Losers:

- Real estate investment trusts declined

- Utility stocks faced pressure

- Consumer discretionary sector showed weakness

Bond Market Implications

Treasury yields responded immediately to the inflation surprise. The 10-year yield climbed 15 basis points as investors repriced Fed expectations.

Fixed Income Strategy:

- Short-term bonds maintain appeal

- TIPS (inflation-protected securities) gained investor interest

- Corporate credit spreads widened modestly

🏠 Regional Inflation Variations

CPI data reveals significant geographic disparities in consumer price inflation:

Highest Inflation Regions:

- West Coast metropolitan areas

- Florida housing markets

- Texas energy corridors

Moderate Inflation Regions:

- Midwest manufacturing hubs

- Southeast rural areas

- Northeast suburban markets

💡 Expert Economic Forecasts

Wall Street Predictions

Leading economists adjust their inflation forecasts following August’s surprising acceleration:

Goldman Sachs: Expects inflation to remain above 2.5% through Q4 2025

JPMorgan: Predicts Fed will pause rate cuts if inflation persists

Bank of America: Maintains recession probability below 30%

Consumer Impact Assessment

Average American households face continued pressure from rising costs:

Monthly Budget Impact:

- Typical family spending up $150 monthly

- Gasoline costs increased $25 per month

- Food expenses rose $40 monthly

- Housing costs climbed $85 monthly

🔍 Global Inflation Comparison

US CPI report 2025 data compares favorably to international peers:

Major Economy Inflation Rates:

- United States: 2.9%

- European Union: 3.4%

- United Kingdom: 3.8%

- Canada: 2.1%

- Japan: 1.9%

⚡ Market Volatility & Trading Strategies

Short-term Trading Opportunities

Active traders capitalize on inflation data releases through various strategies:

Currency Markets:

- Dollar strength against major pairs

- Emerging market pressure continues

- Commodity currencies show resilience

Commodity Trading:

- Gold prices declined on rate cut uncertainty

- Oil markets gained on economic strength

- Agricultural futures mixed on weather concerns

🎯 Investment Implications

Portfolio Positioning

Smart investors adjust allocations based on Fed rate policy expectations:

Recommended Allocations:

- 40% Equities (focus on quality growth)

- 30% Fixed Income (shorter duration)

- 15% Real Assets (REITs, commodities)

- 10% Cash (tactical opportunities)

- 5% Alternative Investments

Sector Rotation Strategy

Institutional investors pivot toward inflation-resistant sectors:

Overweight Positions:

- Technology (pricing power)

- Healthcare (essential services)

- Energy (commodity exposure)

Underweight Positions:

- Utilities (rate sensitive)

- Consumer staples (margin pressure)

- Long-duration bonds

📰 Breaking News Updates

Recent Economic Developments

Labor Market Cooling: Weekly jobless claims surge complicates Fed decision-making process. Employment data suggests economic softening despite persistent inflation.

Congressional Response: House Financial Services Committee schedules emergency hearing on inflation impact. Bipartisan concern over middle-class purchasing power erosion.

International Reactions: G7 finance ministers express concern over synchronized global inflation pressures. Coordinated policy response under consideration.

🚀 Future Outlook & Predictions

Next Three Months

September-November 2025 Expectations:

- Fed implements measured 0.25% rate cuts

- Inflation likely remains above 2.5%

- Holiday spending patterns crucial for Q4 trends

2026 Economic Projections

Economist consensus suggests inflation trends 2025-2026 will moderate gradually:

Base Case Scenario:

- Inflation returns to 2.0-2.5% range by mid-2026

- Fed achieves soft economic landing

- GDP growth maintains 2.0-2.5% pace

Risk Scenarios:

- Upside: Persistent services inflation above 3%

- Downside: Rapid economic cooling triggers recession

❓ Frequently Asked Questions

Q: What does the August 2025 CPI report mean for mortgage rates?

A: Mortgage rates likely remain elevated as the Fed proceeds cautiously with rate cuts. Expect 30-year rates to stay above 6.5% through year-end.

Q: How does this inflation affect retirement planning?

A: Retirees should emphasize inflation-protected investments and consider TIPS allocation increases. Social Security COLA adjustments will reflect higher inflation.

Q: Will the Fed cut rates in September 2025?

A: Yes, markets price 88% probability of 0.25% cut. However, larger reductions appear less likely given sticky inflation pressures.

Q: What sectors benefit from this inflation environment?

A: Energy, technology, and financial sectors typically outperform during inflationary periods with pricing power advantages.

Q: How long will this inflation cycle last?

A: Most economists expect gradual moderation through 2026, though services inflation may prove more persistent than goods prices.

🎉 Key Takeaways & Action Items

Investment Action Plan

- Review Portfolio Allocation: Ensure inflation protection through real assets and quality equities

- Monitor Fed Communications: Watch for policy guidance changes

- Dollar-Cost Average: Maintain disciplined investment approach

- Stay Informed: Follow economic data releases monthly

Personal Finance Steps

- Budget Adjustments: Account for higher food and energy costs

- Debt Management: Consider fixed-rate refinancing opportunities

- Emergency Fund: Maintain 6-month expense cushion

- Career Development: Focus on inflation-resistant skills

💭 Final Thoughts

The August 2025 CPI report represents a critical inflection point for monetary policy and market dynamics. While inflation acceleration concerns investors, the Federal Reserve maintains tools to address price pressures without triggering economic recession.

Smart investors position portfolios for continued volatility while maintaining long-term perspective. The interplay between Fed rate decisions and economic fundamentals will determine market direction through year-end.

Stay informed about developing economic trends and adjust strategies accordingly. This CPI inflation analysis provides foundation for navigating challenging market conditions ahead.

💡 Share this comprehensive CPI analysis with fellow investors. What’s your take on Federal Reserve strategy? Comment below with your market predictions!

🔗 Related Economic Analysis:

- Understanding Federal Reserve Policy Mechanisms

- Inflation Impact on Retirement Planning

- Stock Market Volatility Trading Strategies

📊 Sources: Bureau of Labor Statistics, Federal Reserve Economic Data, Yahoo Finance, Bloomberg Economics